USE CASE

Send SMS for payments and debt collection

Receive more payments on time and recover debts seamlessly with SMS and mobile messaging.

With our automated SMS solutions you can send out timely payment reminders, arrange repayment strategies, reduce late payments, and improve your cash flow.

Recover debt ethically with award-winning SMS solutions that guarantee ROI

Businesses, local governments, debt collectors, debt purchasers and housing associations need debt recovery solutions that are ethical, effective and easy to implement. Our SMS solutions for payments and collections tick all three boxes.

Council tax collection

Esendex enables customers to make council tax payments securely from their phones. Our solutions work with legacy systems, so you can launch digital collections quickly and at low-cost.

‘Self-serve’ payments

Our Mobile Journeys solution helps customers self-manage and repay debt. With many households building up “dangerous” levels of debt, creditors need a scalable solution to recoup monies.

Repayment strategies

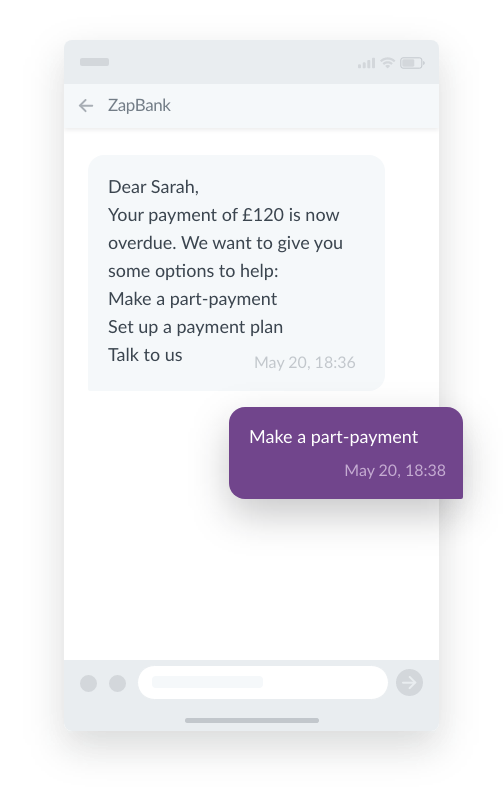

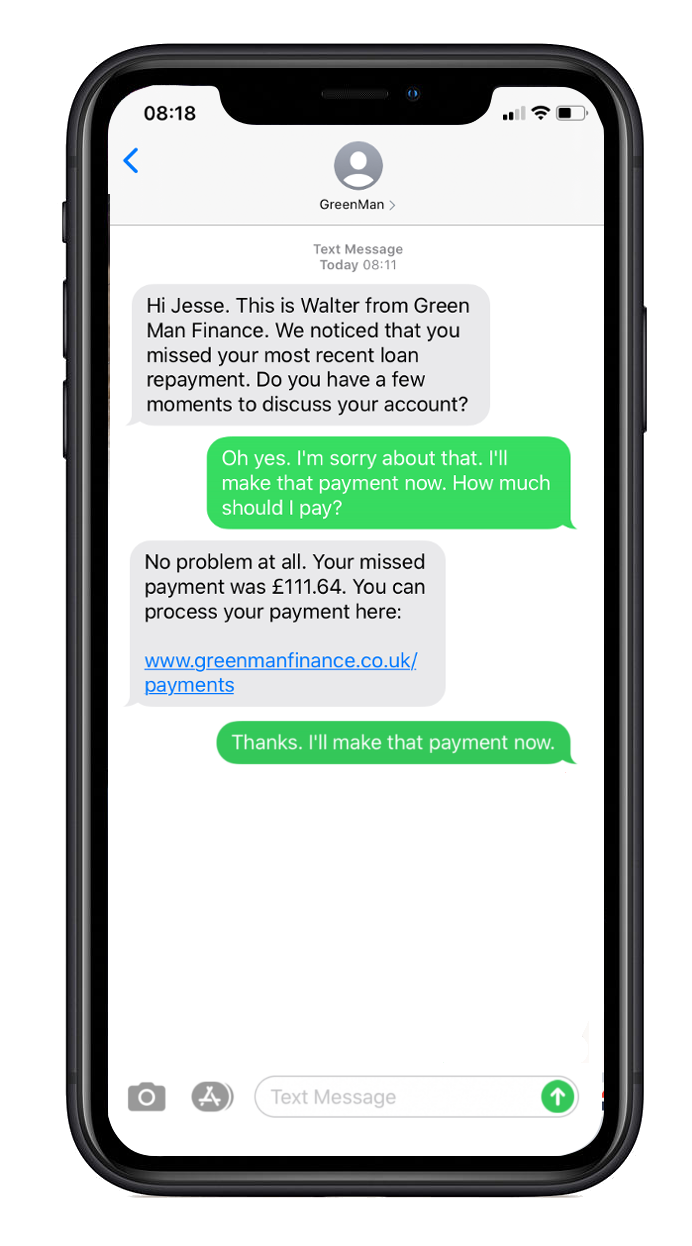

Our messaging strategies are tailored to help increase repayments by moving from blanket, one-way communication to individualised, conversational messaging.

Debt Purchaser solutions

With our SMS solutions, debt purchasers can increase collection rates, and reduce costs with little to no increase in FTE resource commitments.

Final balance collection

Our collection solutions for utility companies are low-cost, can be adapted to customer behaviour while solving the challenge of collecting small value final balance debt.

Debt collection and repayment solutions with seamless mobile journeys

Remind customers of upcoming debits, and encourage proactive payments with SMS and mobile messaging channels.

Esendex offers ethical and effective mobile strategies for recovering and managing debt. We can help you create a transactional journey that’s convenient for customers and delivers secure and robust mobile payments, all via their handsets.

Partner with business communication experts

We have a wealth of experience in credit and collections, and we bring that to bear in every solution we build. We work collaboratively with you to build tailored communication solutions that solve the particular business challenges you face.

Personalised and effective repayment strategies for better outcomes

Debtors are more likely to respond and repay when collection messages are personalised, sensitive, friendly and well timed.

Offering repayment plans and having interactive 2 way conversations with customers who are in arrears significantly increases repayment rates.

Use ready-to-go templates from our template library or craft your own unique messagess.

Let’s start sending, together.

Discover the full power of our mobile messaging platform.

Recover debt ethically

Esendex’s Mobile Collections solution won the Queen’s Award for Enterprise: Innovation 2020, for its customer-centric approach to ethical debt recovery. All solutions meet FCA and Ofcom requirements regarding the fair treatment of customers – this is baked into the heart of our solution set.

Connect with major networks

With Esendex, your messages go directly to the UK’s major mobile network operators, ensuring speed and reliability of message delivery. Esendex is accredited to PCI Level 1 and UKAS ISO27001, with UK data centres, meaning your data security is in safe hands.

Succeed with strategic support and guidance

We’re dedicated to building messaging solutions that create long-term value for your business. With ongoing guidance and support included with all packages, we’re here to help you optimise our solutions to serve the changing needs of your business.

Let’s start sending, together.

Discover the full power of our mobile messaging platform.

Customer success stories

Increasing final debt payment from 4% to 19%, at a third of the cost of direct mail

Saving time and money for both the customer and Brighton & Hove City Council

Increasing incoming payments with an automated collection service

Increasing final debt payment from 4% to 19% for utility provider E.ON

Using our multichannel platform, we were able to create a solution for utility provider E.ON which increased final debt payment from 4% to 19%. Whilst also enabling npower to:

• Promote friendly, fair, non-intrusive customer contact

• Provide a mobile focused, intelligent, self-serve technology which added convenience for the customer, and reduced the cost to serve

• Create a new workflow to replace any reliance on outbound activity from npower’s call centre

• Achieve payment via the most cost effective communication channel, with the ability to switch between communication channels as required

Insights

What happens after checkout? Improving the post-purchase experience

Business messagingWhat we’ll cover What is the post-purchase experience? Why does the post-purchase experience matter? Examples…Automation & AI Readiness Gap: Which UK sectors are falling behind?

TechnologyWhat we’ll cover The current state of automation and AI adoption in the…How conversational banking is reshaping customer experiences

Customer ServiceWhat we’ll cover What is conversational banking?Why is conversational banking on the rise?Real-world…