In a market where providers are trying to to find ways to win new customers and keep the ones they already have, collecting customer feedback is essential. Find out how SMS Surveys does this in a cost-effective and convenient way.

Accenture recently published a series of articles on ‘The Agile Bank’, and at the core of their research was the finding that financial services providers must:

- Confirm their DNA – what’s at the core of their business and where is it going?

- Diagnose the network – specifically aimed at streamlining physical branches

- Walk in customers’ shoes – understand the customer’s experience and assess their needs

- Test the sweet spots – always seek opportunities to move service effectiveness to the next level.

(They’ve summarised the content in a great infographic you can find here).

It’s a lot to tackle at once, and this blog post is focused on step three: walking in your customers’ shoes.

Although you can (and should) experience first-hand the processes your customers are exposed to, there’s no substitute for hearing from them directly. While there are multiple ways to gather customer feedback, if you’re looking for great response rates, SMS Surveys need to feature in your considerations.

For insurance provider LV, changing from a telephone survey to an SMS Survey increased their response rate from 3% to 27% – and was less expensive.

How can SMS Surveys be used within the financial sector?

SMS Surveys can help financial service providers in a wide variety of ways, but here are some of the common ways that our customers are using them:

![]() Customer satisfaction / Market research surveys

Customer satisfaction / Market research surveys

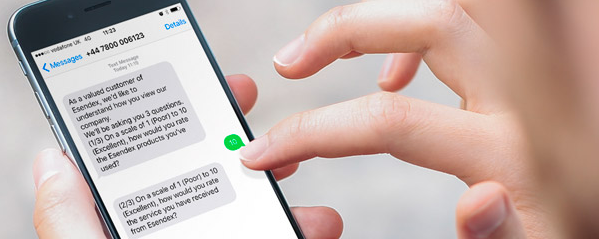

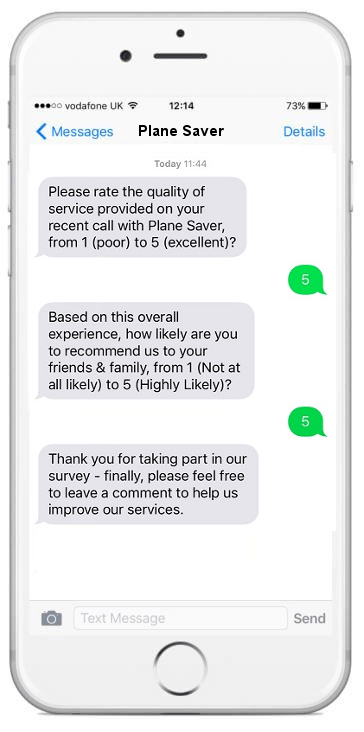

From yes/no responses, rating scales, Net Promoter Scoring, multiple choice and free text fields, there is plenty of flexibility within an SMS Survey to collect qualitative and quantitative data on your customer experience.

Branched surveys allow a hierarchy of questions to be set up, meaning that the question currently being asked is a consequence of the response to the previous one. This makes them perfect for gathering more specific information, like individual product and service requirements.

Click here to find out how Plane Saver credit union increased their levels of customer feedback and reduced their costs to collect data by using SMS Surveys.

Data cleansing

It’s essential for financial service providers to regularly update their customers’ details to ensure that appropriate communications are being sent. SMS Surveys present an easy and cost-effective way to do this. Using a linear survey, personal details, preferences and requirements can all be quickly updated at a time and date which suits the customer.

Another platform that works well for this purpose is a mobile web app such as Mobile Journeys, as the integration with your current CRM system means that all known fields can be shown pre-completed, so the customer can just check off what’s correct and what needs updating.

Staff surveys

Are your staff on board with the changes you’re making to your organisation? Do they understand what it is that you’re trying to achieve? Are they happy with their work? SMS Surveys work just as effectively to gather staff sentiments as they do customers’. They can also be used as a tool to gather ideas from staff to drive the business forward.

By targeting their mobile devices staff can carry out surveys at any time with no need to be in the office. Analysis of the results can then take place, and changes can be made to make sure staff are happy and productive.

Want to know more?

SMS Surveys can be created and sent using our intuitive online platform, and can also be easily integrated into financial service providers’ existing systems, or used in tandem with other communication channels.

If you’re interested to know more about how the Esendex SMS Surveys platform can be used to help drive better decisions in your organisation, please get in contact with our team today on 0345 356 5758 or email us at [email protected].

Customer satisfaction / Market research surveys

Customer satisfaction / Market research surveys